Dollar index trading at 96.15 (+0.31%)

Strength meter (today so far) - Aussie -0.20%, Kiwi +0.40%, Loonie -0.20%.

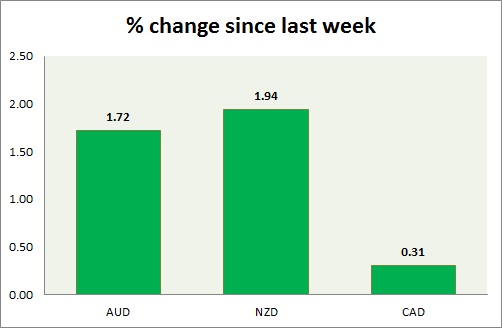

Strength meter (since last week) - Aussie +1.72%, Kiwi +1.94%, Loonie +0.31%.

AUD/USD -

Trading at 0.703

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.705

Economic release today -

- National Australia banks' business confidence dropped to 1 from 4 prior, while business conditions improved to 11 in August from 6.

Commentary -

- Aussie is consolidating around 0.7 mark today. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.64

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.65

Economic release today -

- RBNZ rate decision scheduled at 21:00 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi is the best performer today, heading into RBNZ monetary policy.

USD/CAD -

Trading at 1.322

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- BOC held policy steady.

- Housing starts rose to 216,900 in August from 193,300 prior.

- Building permits dropped by -0.6% in July.

Commentary -

- Loonie benefited from BOC monetary policy hold, while lower oil price provided downside pressure.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary