Dollar index trading at 95.54 (-0.42%)

Strength meter (today so far) - Aussie +1.66%, Kiwi +0.61%, Loonie +0.55%.

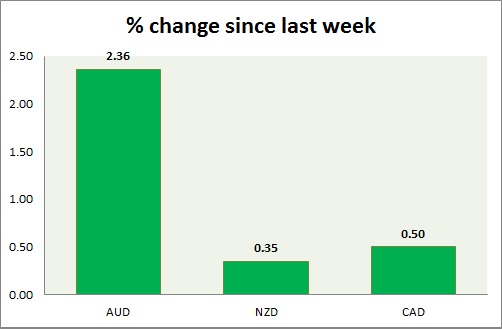

Strength meter (since last week) - Aussie +2.36%, Kiwi +0.35%, Loonie +0.50%.

AUD/USD -

Trading at 0.707

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.705

Economic release today -

- Australia's unemployment rate dropped to 6.2% in August.

Commentary -

- Aussie is best performer this week, gaining today over better employment report.. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.63

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.65

Economic release today -

- RBNZ cuts rates by 25 basis points.

- Business PMI to be released at 22:30 GMT, followed by food price index at 22:45 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi dropped as RBNZ cuts rates by 25 basis points today.

USD/CAD -

Trading at 1.32

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- New house price index rose by 0.1% in August.

Commentary -

- Loonie is consolidating, awaiting further clarity over next move.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate