Dollar index trading at 94.63 (-0.27%)

Strength meter (today so far) – Aussie -0.02%, Kiwi +0.02%, Loonie +0.11%

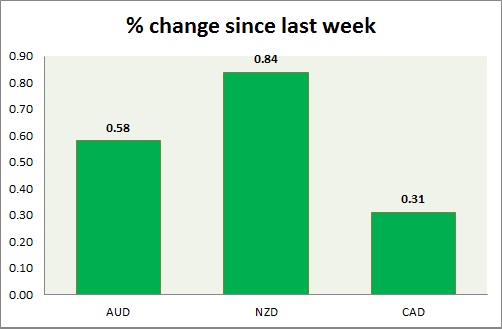

Strength meter (since last week) – Aussie +0.58%, Kiwi +0.84%, Loonie +0.31%

AUD/USD –

Trading at 0.768

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765 (testing), Short term – 0.77 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8

Economic release today –

- Investment lending for homes down 6.2 percent in October and Home loans down 2.3 percent.

Commentary –

- Aussie is down today but up this week as iron ore price up in China trading and positive China trade balance.

NZD/USD –

Trading at 0.695

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.68

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- Electronic card retail sales report will be released at 21:45 GMT.

Commentary –

- Kiwi is likely to decline towards 0.64 area.

USD/CAD –

Trading at 1.271

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.28

Economic release today –

- New House price index for September will be updated at 13:30 GMT.

Commentary –

- Loonie is the worst performer of the week over lumber dispute with the United States despite higher oil price but turned positive on the dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX