Dollar index trading at 89.86 (-0.26%)

Strength meter (today so far) – Euro +0.07%, Franc +0.41%, Yen +0.24%, GBP +0.22%

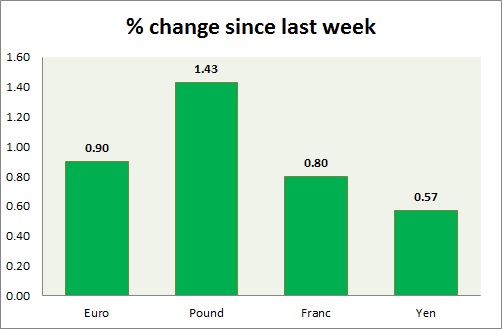

Strength meter (since last week) – Euro +0.90%, Franc +0.80%, Yen +0.57%, GBP +1.43%

EUR/USD –

Trading at 1.231

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Buy

Support

- Long term – 1.16, Medium term – 1.18, Short term – 1.2

Resistance –

- Long term – 1.25, Medium term – 1.235, Short term – 1.235

Economic release today –

- Flash PMI reports will be released at 9:00 GMT.

Commentary –

- The euro is up this week on weaker dollar. Active call – Buy targeting 1.25

GBP/USD –

Trading at 1.404

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.305, Medium term – 1.335, Short term – 1.35

Resistance –

- Long term – 1.42 Medium term – 1.405, Short term – 1.38 (broken)

Economic release today –

- UK unemployment report will be released at 9:30 GMT.

Commentary –

- The pound is the best performer of the week. Active call- Buy targeting 1.44

USD/JPY –

Trading at 109.9

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Flash manufacturing PMI report shows that the index rose to 54.4

Commentary –

- The yen is timid due to lack of risk aversion and BoJ signals no tapering yet. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.953

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is up in line with the euro. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX