Dollar index trading at 89.27 (+0.23%)

Strength meter (today so far) – Euro -0.19%, Franc -0.69%, Yen -0.16%, GBP -0.53%

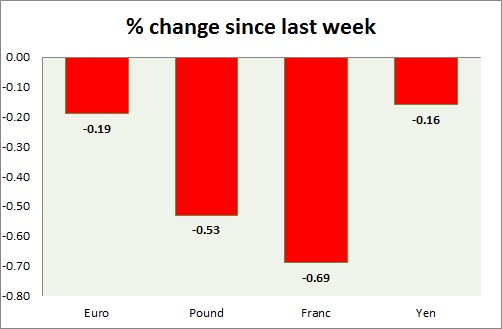

Strength meter (since last week) – Euro -0.19%, Franc -0.69%, Yen -0.16%, GBP -0.53%

EUR/USD –

Trading at 1.239

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Buy

Support

- Long term – 1.18, Medium term – 1.2, Short term – 1.22

Resistance –

- Long term – 1.25, Medium term – 1.25, Short term – 1.25

Economic release today –

- NIL

Commentary –

- The euro is down today as the dollar recovers after last week’s selloff. Active call – Buy targeting 1.25

GBP/USD –

Trading at 1.406

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.35, Medium term – 1.385, Short term – 1.385

Resistance –

- Long term – 1.50 Medium term – 1.485, Short term – 1.435

Economic release today –

- NIL

Commentary –

- The pound is the down this week on a stronger dollar. Active call- Buy targeting 1.44

USD/JPY –

Trading at 108.7

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4 (testing)

Resistance –

- Long term – 116, Medium term – 112, Short term – 110

Economic release today –

- Unemployment and household spending reports will be released at 23:30 GMT.

- Retail sales report will be released at 23:50 GMT.

Commentary –

- The yen is timid due to lack of risk aversion but relatively better performer today. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.936

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.92

Resistance –

- Long term – 1.03, Medium term – 0.98, Short term – 0.95

Economic release today –

- NIL

Commentary –

- Franc is the worst performer of the day so far. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022