Dollar index trading at 88.91 (-0.30%)

Strength meter (today so far) – Euro +0.40%, Franc +0.21%, Yen +0.11%, GBP +0.12%

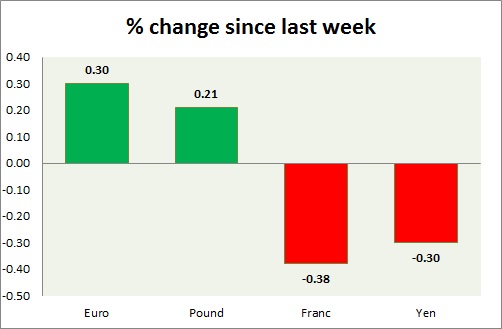

Strength meter (since last week) – Euro +0.30%, Franc -0.38%, Yen -0.30%, GBP +0.21%

EUR/USD –

Trading at 1.242

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Buy

Support

- Long term – 1.18, Medium term – 1.2, Short term – 1.22

Resistance –

- Long term – 1.25, Medium term – 1.25, Short term – 1.25

Economic release today –

- Eurozone unemployment rate at 8.7 percent in December.

- Consumer price inflation at 1.3 percent y/y in January, core inflation up 1 percent y/y.

Commentary –

- The euro is the best performer of the week. Active call – target reached1.25

GBP/USD –

Trading at 1.412

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.35, Medium term – 1.385, Short term – 1.385

Resistance –

- Long term – 1.50 Medium term – 1.485, Short term – 1.435

Economic release today –

- GFK consumer confidence index improved to -9 in December.

- BRC shop price index is down -0.5 percent in December.

Commentary –

- The pound recovered on the back of a weaker dollar. Active call- Target reached at 1.43

USD/JPY –

Trading at 108.6

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4 (testing)

Resistance –

- Long term – 116, Medium term – 112, Short term – 110

Economic release today –

- NIL

Commentary –

- The yen is timid due to lack of risk aversion. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.933

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.92

Resistance –

- Long term – 1.03, Medium term – 0.98, Short term – 0.95

Economic release today –

- UBS consumption indicator at 1.69 in December.

- Zew survey expectation declined to 34.5 in December from 52

Commentary –

- Franc is the worst performer of the week so far. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX