Dollar index trading at 90.74 (+0.10%)

Strength meter (today so far) – Euro -0.09%, Franc -0.31%, Yen -0.31%, GBP +0.08%

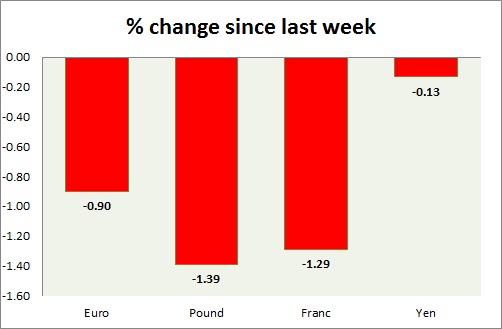

Strength meter (since last week) – Euro -0.90%, Franc -1.29%, Yen -0.13%, GBP -1.39%

EUR/USD –

Trading at 1.218

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Buy

Support

- Long term – 1.18, Medium term – 1.2, Short term – 1.22

Resistance –

- Long term – 1.25, Medium term – 1.25, Short term – 1.25

Economic release today –

- Eurozone manufacturing PMI rose to 58.6 in February.

- Eurozone unemployment rate at 8.6 percent in January.

Commentary –

- The euro is down this week as the dollar recovers over rate hike bets.

GBP/USD –

Trading at 1.376

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.35, Medium term – 1.385, Short term – 1.385

Resistance –

- Long term – 1.50 Medium term – 1.485, Short term – 1.435

Economic release today –

- Net lending to individuals at £4.7 billion in January.

- Mortgage approvals were 67,478 in January.

- M4 money supply up 4.3 percent y/y.

- Manufacturing PMI declined to 55.2 in February.

Commentary –

- The pound is the worst performer of the week. Gave up earlier gains on hawkish BoE commentary due to domestic political trouble. Active call- short term sell targeting 1.375

USD/JPY –

Trading at 107

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 101, Medium term – 104.2, Short term – 106

Resistance –

- Long term – 112, Medium term – 110, Short term – 109

Economic release today –

- Nikkei manufacturing PMI rose to 54.1 in February.

- Inflation reports will be released at 23:30 GMT, along with unemployment report and household spending report.

Commentary –

- The yen is the best performer of the week but down against the dollar. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.947

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.92

Resistance –

- Long term – 1.03, Medium term – 0.98, Short term – 0.95

Economic release today –

- GDP grew by 1.9 percent y/y in the fourth quarter.

- Real retail sales down 1.4 percent y/y in January.

- SVME PMI rose to 65.5 in February.

Commentary –

- Franc is a much worse performer than the euro this week so far.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX