Dollar index trading at 100.3 (+0.46%).

Strength meter (today so far) - Euro -0.50%, Franc -0.23%, Yen -0.45%, GBP -0.93%

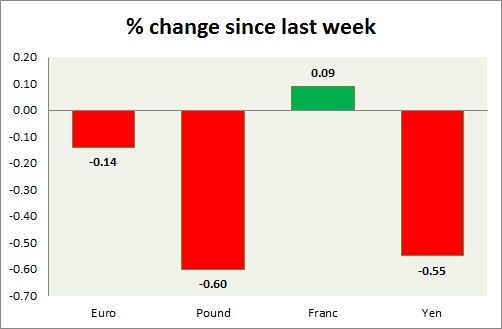

Strength meter (since last week) - Euro -0.14%, Franc +0.09%, Yen -0.55, GBP -0.60%

EUR/USD -

Trading at 1.057

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 0.98, Medium term - 1.02, Short term - 1.048

Resistance -

- Long term - 1.145, Medium term - 1.104, Short term - 1.083

Economic release today -

- Euro zone consumer prices rose by 0.1% in November, while core grew by 0.9%.

Commentary -

- Euro is keeping to the low, heading towards ECB meeting. Active call - Euro to drop towards parity.

GBP/USD -

Trading at 1.494

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 1.46, Medium term - 1.475, Short term - 1.495

Resistance -

- Long term - 1.55, Medium term - 1.54, Short term - 1.532

Economic release today -

- Construction PMI came at 55.3 in November.

Commentary -

- Pound is the worst performer today and this week as rate hike expectations got pushed back further.. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 123.4

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 115.5-116.5, Medium term - 118.5, Short term - 120.3

Resistance -

- Long term - 130, Medium term - 128, Short term - 125.4

Economic release today -

- NIL

Commentary -

- Yen is down against Dollar, need to break above 123.7 for further momentum. Active call - Buy USD/JPY @ 121.9 targeting 123.2, 125, 127, with stop loss around 120, 118.

USD/CHF -

Trading at 1.028

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is the best performer today.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022