Dollar index trading at 97.46 (-0.18%).

Strength meter (today so far) - Euro +0.38%, Franc +0.29%, Yen +0.13%, GBP -0.49%

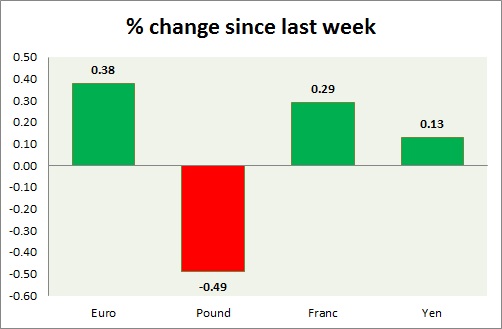

Strength meter (since last week) - Euro +0.38%, Franc +0.29%, Yen +0.13%, GBP -0.49%

EUR/USD -

Trading at 1.102

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy

Support

- Long term - 0.98, Medium term - 1.02, Short term - 1.048

Resistance -

- Long term - 1.145, Medium term - 1.104, Short term - 1.1

Economic release today -

- Euro Zone industrial production rose 0.6% in October, up 1.9% from a year ago.

Commentary -

- Euro on the rise ahead of FED meeting. Active Call - Buy Euro @1.09 and at dips targeting 1.155 area and stop loss at 1.05

GBP/USD -

Trading at 1.515

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/buy

Support -

- Long term - 1.46, Medium term - 1.475, Short term - 1.495

Resistance -

- Long term - 1.55, Medium term - 1.54, Short term - 1.532

Economic release today -

- Rightmove house price index dropped -1.3% in November.

Commentary -

- Pound recovered sharply from big drop after BOE rate decision. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area. Interim call - Buy Pound @1.506 with stop loss at 1.495 and target at 1.528, 1.54 and 1.56.

USD/JPY -

Trading at 120.7

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 115.5-116.5, Medium term - 118.5, Short term - 120.3

Resistance -

- Long term - 130, Medium term - 128, Short term - 125.4

Economic release today -

- Industrial production, down -1.4% in October, but tertiary industry index up 0.9% in October.

Commentary -

- Yen gave up some of its last week's gains as equities recover.

USD/CHF -

Trading at 0.98

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc remains closely linked to Euro's movement.