Dollar index trading at 93.87 (-0.20%)

Strength meter (today so far) – Euro +0.15%, Franc +0.21%, Yen -0.08%, GBP +0.29%

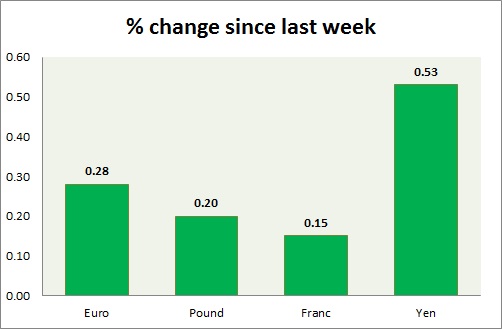

Strength meter (since last week) – Euro +0.28%, Franc +0.15%, Yen +0.53%, GBP +0.20%

EUR/USD –

Trading at 1.168

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.12, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.25, Medium term – 1.22, Short term – 1.2

Economic release today –

- Unemployment rate declined to 8.5 percent in April.

- CPI inflation up 1.1 percent in May, up 1.9 percent from a year ago.

Commentary –

- The euro recovered as the dollar declined from key resistance and as Italy is on its way to form a government, ending the crisis at least temporarily. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.14

GBP/USD –

Trading at 1.332

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.32, Medium term – 1.35, Short term – 1.35 (broken)

Resistance –

- Long term – 1.425 Medium term – 1.39, Short term – 1.37

Economic release today –

- Net lending to individuals at £5.7 billion.

- Mortgage approvals at 62,455 in April

- M4 money supply up 1.1 percent y/y in April.

Commentary –

- The pound recovered as Italian political tensions ease and dollar declined. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.3

USD/JPY –

Trading at 108.8

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 101, Medium term – 104.2, Short term – 106.2

Resistance –

- Long term – 111, Medium term – 109, Short term – 109

Economic release today –

- Housing starts up 0.3 percent y/y in April.

- Construction orders up 4 percent y/y in April.

Commentary –

- The yen is still the best performer of the week.

USD/CHF –

Trading at 0.986

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- KOF leading indicator declined to 100 in May.

- Zew survey index rose to 28 in May.

- SNB chairman Jordon is set for a speech at 14:45 GMT.

Commentary –

- Franc is the worst performer of the week so far but recovered from loss and now up against the dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed