Dollar index trading at 99.46 (+0.12%).

Strength meter (today so far) - Euro +0.01%, Franc +0.01%, Yen +0.40%, GBP -0.21%

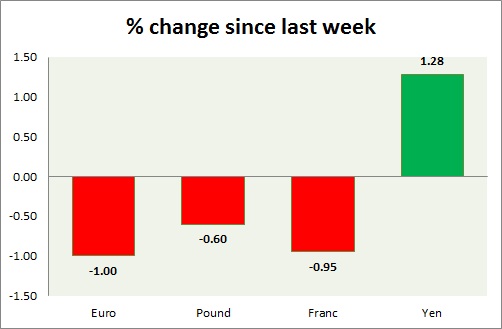

Strength meter (since last week) - Euro -1.00%, Franc -0.95%, Yen +1.28%, GBP -0.60%

EUR/USD -

Trading at 1.075

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy

Support

- Long term - 0.98, Medium term - 1.02, Short term - 1.048

Resistance -

- Long term - 1.145, Medium term - 1.104, Short term - 1.1

Economic release today -

- Euro Zone services PMI came at 54.2.

Commentary -

- Euro selloff continued throughout the day, only abating heading into New York session. Active Call - Buy Euro @1.09 and at dips targeting 1.155 area and stop loss at 1.05

GBP/USD -

Trading at 1.464

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range

Support -

- Long term - 1.46, Medium term - 1.475, Short term - 1.49 (broken)

Resistance -

- Long term - 1.55, Medium term - 1.54, Short term - 1.52

Economic release today -

- UK services PMI came at 57.8 for December.

Commentary -

- Still no sign of buyers in Pound. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 118.6

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 115.5-116.5, Medium term - 118.5, Short term - 120.3

Resistance -

- Long term - 130, Medium term - 128, Short term - 125.4

Economic release today -

- NIL

Commentary -

- Yen continuing its gain as equities continue to sell off.

USD/CHF -

Trading at 1.009

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is moving in line with Euro. Active call - Sell USD/CHF @0.985 and at rallies - targeting 0.895 area and stop loss at 1.03 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX