Dollar index trading at 94.72 (-0.63%)

Strength meter (today so far) – Euro +0.81%, Franc +0.54%, Yen -0.13%, GBP +0.63%

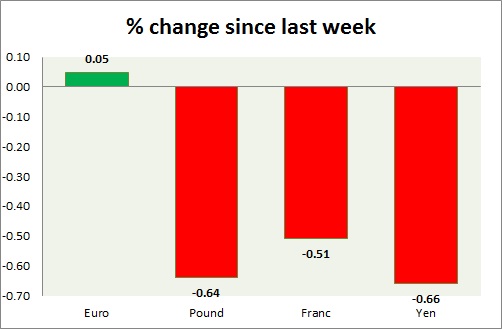

Strength meter (since last week) – Euro +0.05%, Franc -0.51%, Yen -0.66%, GBP -0.64%

EUR/USD –

Trading at 1.165

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.12, Medium term – 1.16, Short term – 1.16 (broken)

Resistance –

- Long term – 1.25, Medium term – 1.22, Short term – 1.2

Economic release today –

- CPI inflation up 2 percent y/y in June.

Commentary –

- The euro declined as the dollar gains further grounds over higher interest rate spread. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.14

GBP/USD –

Trading at 1.315

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.24, Medium term – 1.27, Short term – 1.3 (testing)

Resistance –

- Long term – 1.37 Medium term – 1.35, Short term – 1.33

Economic release today –

- Q1 GDP at 1.2 percent y/y.

- Mortgage approvals at 64,526 in June.

- M4 money supply up 1.8 percent y/y in May.

Commentary –

- The pound is the worst performer of the week on a stronger dollar. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.3

USD/JPY –

Trading at 110.7

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 101, Medium term – 104.2, Short term – 106.2

Resistance –

- Long term – 111, Medium term – 111, Short term – 109 (broken)

Economic release today –

- Housing starts up 1.3 percent y/y in May.

- Consumer confidence declined to 43.7 in June.

Commentary –

- The yen is down on strong dollar and as equities recover.

USD/CHF –

Trading at 0.992

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- KOF leading indicator rose to 101.7 in June.

Commentary –

- Franc is a much worse performer than the euro this week as political turmoil in Europe ease a bit.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022