Dollar index trading at 98.89 (+0.01%).

Strength meter (today so far) - Euro +0.07%, Franc +0.10%, Yen +0.30%, GBP -0.05%

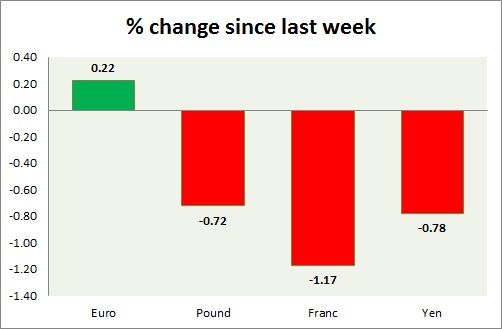

Strength meter (since last week) - Euro +0.22%, Franc -1.17%, Yen -0.78%, GBP -0.72%

EUR/USD -

Trading at 1.088

Trend meter -

- Long term - Sell, Medium term - Range/Buy, Short term - Range/Sell

Support

- Long term - 1.048, Medium term - 1.048, Short term - 1.06

Resistance -

- Long term - 1.145, Medium term - 1.104, Short term - 1.1

Economic release today -

- NIL

Commentary -

- Euro rose sharply over rumor on no further action from ECB. Active Call - Buy Euro @1.09 and at dips targeting 1.155 area and stop loss at 1.05

GBP/USD -

Trading at 1.44

Trend meter -

- Long term - Range/Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 1.425, Medium term - 1.445, Short term - 1.445

Resistance -

- Long term - 1.52, Medium term - 1.5, Short term - 1.482

Economic release today -

- BOE maintained policy steady.

Commentary -

- Pound struggling to finders. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 117.8

Trend meter -

- Long term - Sell, Medium term - Range/ Sell, Short term - Sell

Support -

- Long term - 115.5-116.5, Medium term - 116.5, Short term - 116.5

Resistance -

- Long term - 123.8, Medium term - 123.8, Short term - 119.5

Economic release today -

- NIL

Commentary -

- Yen remains well bid due to risk aversion Active call - Sell Yen @119.5 with stop loss around 123.8 and target at 114 and 110.

USD/CHF -

Trading at 1.005

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is the worst performer this week. Active call - Sell USD/CHF @0.985 and at rallies - targeting 0.895 area and stop loss at 1.03 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed