Dollar index trading at 96.63 (-0.37%)

Strength meter (today so far) – Euro +0.51%, Franc +0.70%, Yen -0.69%, GBP +0.56%

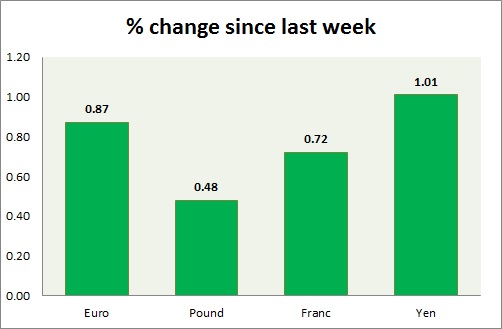

Strength meter (since last week) – Euro +0.87%, Franc +0.72%, Yen +1.01%, GBP +0.48%

EUR/USD –

Trading at 1.141

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support

- Long term – 1.10, Medium term – 1.12, Short term – 1.123

Resistance –

- Long term – 1.22, Medium term – 1.18, Short term – 1.153

Economic release today –

- NIL

Commentary –

- The euro is heading higher as the dollar weakens after Sino-American trade truce. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095 area.

GBP/USD –

Trading at 1.28

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.19, Medium term – 1.23, Short term – 1.268

Resistance –

- Long term – 1.35 Medium term – 1.337, Short term – 1.326

Economic release today –

- Ahead of Brexit Services PMI declines to lowest in 28 months to 50.4

Commentary –

- The pound remains volatile over Brexit deal comments and news. Up today, as the dollar weakens. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25

USD/JPY –

Trading at 112.3

Trend meter -

- Long term – Sell, Medium term – buy, Short term – Range/Buy

Support –

- Long term – 106.2, Medium term – 109.2, Short term – 111

Resistance –

- Long term – 117, Medium term – 114, Short term – 114

Economic release today –

- Household spending report will be released at 23:30 GMT.

Commentary –

- The yen remains trapped in bull/bear fight amid risk aversion and a strong dollar. The best performer of the week over risk aversion and weaker USD.

USD/CHF –

Trading at 0.99

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.97

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00 (testing)

Economic release today –

- NIL

Commentary –

- Franc is the worst performer this week but up against the USD.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022