Dollar index trading at 96.66 (-0.34%)

Strength meter (today so far) – Euro +0.47%, Franc +0.08%, Yen +0.29%, GBP -0.05%

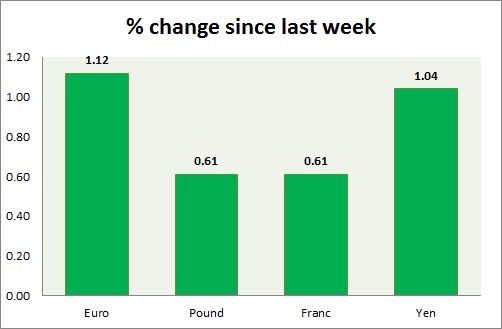

Strength meter (since last week) – Euro +1.12%, Franc +0.61%, Yen +1.04%, GBP +0.61%

EUR/USD –

Trading at 1.143

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support

- Long term – 1.10, Medium term – 1.12, Short term – 1.123

Resistance –

- Long term – 1.22, Medium term – 1.18, Short term – 1.153

Economic release today –

- Construction output up 1.8 percent y/y in October.

Commentary –

- The euro is the best performer this week as Italy reaches agreements on Budget with Brussels bureaucrats. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095 area.

GBP/USD –

Trading at 1.265

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.19, Medium term – 1.23, Short term – 1.268

Resistance –

- Long term – 1.35 Medium term – 1.337, Short term – 1.326

Economic release today –

- RPI up 3.2 percent y/y in November.

- PPI input up 5.6 percent y/y.

- PPI output up 3.1 percent y/y.

- CPI inflation up 2.3 percent y/y.

- Core CPI up 2.4 percent y/y.

Commentary –

- The pound is up this week on a weaker USD. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25 and 1.21

USD/JPY –

Trading at 112.2

Trend meter -

- Long term – Sell, Medium term – buy, Short term – Range/Sell

Support –

- Long term – 106.2, Medium term – 109.2, Short term – 111

Resistance –

- Long term – 117, Medium term – 114, Short term – 114

Economic release today –

- NIL

Commentary –

- The yen remains trapped in bull/bear fight amid risk aversion and strong dollar. Rising this week amid rising risk aversion in the market and a weaker USD.

USD/CHF –

Trading at 0.992

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.97

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is up this week riding on a weaker USD but much worse performer than the euro.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed