Dollar index trading at 96.82 (-0.07%).

Strength meter (today so far) - Euro +0.02%, Franc -0.22%, Yen +0.07%, GBP +0.02%

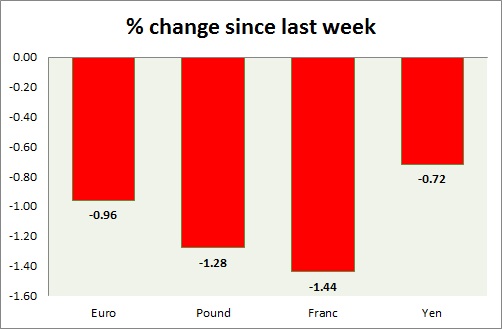

Strength meter (since last week) - Euro -0.96%, Franc -1.44%, Yen -0.72%, GBP -1.28%

EUR/USD -

Trading at 1.114

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Buy

Support

- Long term - 1.048, Medium term - 1.07, Short term - 1.078

Resistance -

- Long term - 1.18, Medium term - 1.15, Short term - 1.13

Economic release today -

- Zew survey economic sentiment dropped to 13.6 from 22.7 prior.

Commentary -

- Euro struggling in the face of rising equities and stronger Dollar. Active Call - Buy Euro @1.09 and at dips targeting 1.155 area and stop loss at 1.05

GBP/USD -

Trading at 1.43

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 1.405, Medium term - 1.415, Short term - 1.42

Resistance -

- Long term - 1.52, Medium term - 1.52, Short term - 1.467

Economic release today -

- UK unemployment rate at 5.1% and wage growth at 2% excluding bonus.

Commentary -

- Pound relatively better performer today, facing heavy intraday swings.

USD/JPY -

Trading at 114.1

Trend meter -

- Long term - Sell, Medium term - Range/ Sell, Short term - Sell

Support -

- Long term - 115.5-116.5 (broken), Medium term - 116.5 (broken), Short term - 116.5 (broken)

Resistance -

- Long term - 123.8, Medium term - 123.8, Short term - 120.5

Economic release today -

- Machinery orders will be released at 23:30 GMT.

Commentary -

- Yen is still the best performer of the week. Active call - Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF -

Trading at 0.99

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 1.01

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL.

Commentary -

- Franc is worst performer this week. Active call - Sell USD/CHF @0.985 and at rallies - targeting 0.895 area and stop loss at 1.03 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX