Dollar index trading at 97.95 (+0.75%)

Strength meter (today so far) - Euro -1.3%, Franc -0.98%, Yen -0.79%, GBP -0.23%

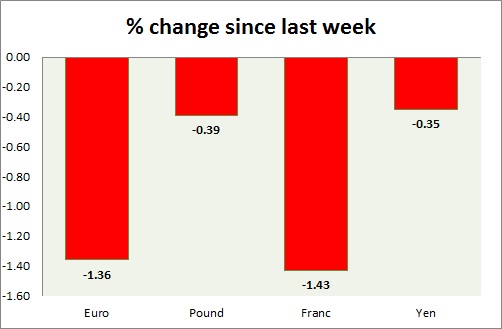

Strength meter (since last week) - Euro -1.36%, Franc -1.43%, Yen -0.35%, GBP -0.39%

EUR/USD -

Trading at 1.086

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Sell

Support

- Long term - 1.048, Medium term - 1.07, Short term - 1.078

Resistance -

- Long term - 1.15, Medium term - 1.137, Short term - 1.107

Economic release today -

- ECB reduced main refinance rate by 0.05% to zero.

- Reduced Marginal lending facility rate by 0.05% to 0.25%

- Reduced deposit rates by 0.1% to -0.4%

- Introduced four new LTROs

- Added non-bank corporates to PSPP.

Commentary -

- Euro is down sharply after ECB fires big.

GBP/USD -

Trading at 1.417

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.35, Medium term - 1.35, Short term - 1.38

Resistance -

- Long term - 1.463, Medium term - 1.425, Short term - 1.405

Economic release today -

- NIL

Commentary -

- Pound is down over stronger Dollar but best performer today.

USD/JPY -

Trading at 114.1

Trend meter -

- Long term - Sell, Medium term - Range/ Sell, Short term - Sell

Support -

- Long term - 98.5, Medium term - 108, Short term - 110

Resistance -

- Long term - 121, Medium term - 117, Short term - 115

Economic release today -

- NIL

Commentary -

- Yen lost grounds as equities rally amid stronger Dollar. Active call - Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF -

Trading at 1.007

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.905, Medium term - 0.945, Short term - 0.98

Resistance -

- Long term - 1.174, Medium term - 1.07, Short term - 1.035

Economic release today -

- NIL

Commentary -

- Franc is down in line with Euro as it means more stimulus direct or indirect from SNB.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022