Dollar index trading at 96.88 (+0.25%)

Strength meter (today so far) – Euro +0.91%, Franc +0.96%, Yen +1.01%, GBP +1.41%

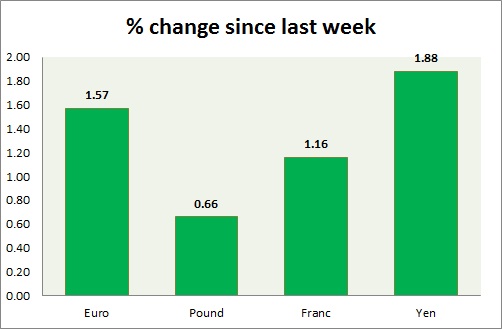

Strength meter (since last week) – Euro +1.57%, Franc +1.16%, Yen +1.88%, GBP +0.66%

EUR/USD –

Trading at 1.132

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.08

Resistance –

- Long term – 1.15, Medium term – 1.137, Short term – 1.12 (broken)

Economic release today –

- CPI rose 0.2% in February, down -0.2% from a year ago. Core consumer price up 0.8% from a year ago.

Commentary –

- As expected Euro is rising post FOMC and we expect it to rise further. Our longer term target for Euro to reach as high as 1.20 against Dollar. However in the short run it might find resistance around 1.143 area.

GBP/USD –

Trading at 1.446

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.41

Resistance –

- Long term – 1.463, Medium term – 1.44, Short term – 1.44

Economic release today –

- BOE kept rates on hold.

Commentary –

- Pound has finally started responding according to our expectations. Weaker Dollar and cheer pound is doing the trick. Likely to gain towards 1.5 area.

USD/JPY –

Trading at 111.7

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 110

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- NIL

Commentary –

- Yen rose to 17 month high against Dollar today but dropped sharply largely due to fading risk aversion and profit bookings. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.968

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.98

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- SNB kept policy on hold. Revised growth and inflation forecast down.

Commentary –

- SNB maintained policy. We expect Franc to strengthen against Dollar to as high as 0.9 area.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX