Dollar index trading at 95.51 (+0.10%)

Strength meter (today so far) – Euro -0.08%, Franc +0.03%, Yen +0.42%, GBP -0.81%

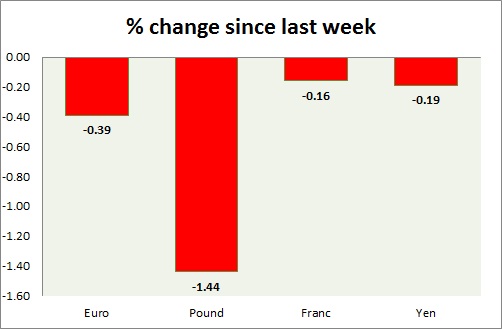

Strength meter (since last week) – Euro -0.39%, Franc -0.16%, Yen -0.19%, GBP -1.44%

EUR/USD –

Trading at 1.122

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.048, Medium term – 1.07, Short term – 1.08

Resistance –

- Long term – 1.15, Medium term – 1.137, Short term – 1.137

Economic release today –

- Manufacturing PMI came at 51.4 in March.

- Services PMI up to 54

Commentary –

- Euro weak today due to stronger Dollar and blasts in Brussels. Our longer term target for Euro to reach as high as 1.20 against Dollar. However in the short run it might find resistance around 1.143 area.

GBP/USD –

Trading at 1.424

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 1.35, Medium term – 1.38, Short term – 1.41

Resistance –

- Long term – 1.463, Medium term – 1.45, Short term – 1.45

Economic release today –

- Retail sales rose by 0.5% in February, up 1.3% from a year ago.

- Consumer prices rose by 0.2% in February, up 0.3% from a year ago.

- Core consumer price rose 1.2% from a year ago.

- Producer price index output declined by -1.15 from a year ago.

- House price index rose by 7.9% from a year ago.

Commentary –

- Pound is worst performer today fuelled by Moody’s warning of credit downgrade and Brussels blasts. We still expects pound to grow stronger going ahead. Likely to gain towards 1.5 area.

USD/JPY –

Trading at 111.7

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 108, Short term – 110

Resistance –

- Long term – 121, Medium term – 117, Short term – 115

Economic release today –

- Manufacturing PMI came at 49.1 for March.

- All industry activity index declined by -0.9%.

Commentary –

- Yen is relatively weaker today as Nikkei turned out as best performing major stock market. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5

USD/CHF –

Trading at 0.97

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.945, Short term – 0.98

Resistance –

- Long term – 1.174, Medium term – 1.07, Short term – 1.035

Economic release today –

- Trade balance for February came at $4.07 billion.

Commentary –

- We expect Franc to strengthen against Dollar to as high as 0.9 area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022