Dollar index trading at 95.71 (-0.1%)

Strength meter (today so far) – Euro +0.25%, Franc +0.05%, Yen -0.94%, GBP +0.08%

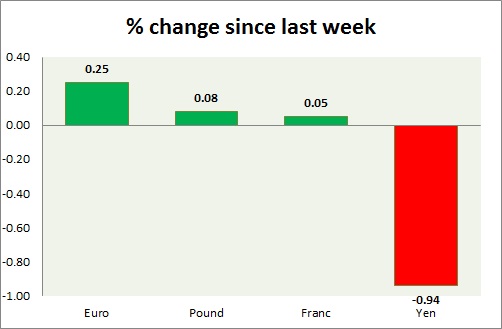

Strength meter (since last week) – Euro +0.25%, Franc +0.05%, Yen -0.94%, GBP +0.08%

EUR/USD –

Trading at 1.114

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.13

Economic release today –

- Euro Zone consumer sentiment came at -7; services sentiment came at 11.3; industrial confidence came at -3.6, economic sentiment came at 104.7; business climate came at 0.26

Commentary –

- Euro is trying to gain back some ground after last week’s big decline.

GBP/USD –

Trading at 1.463

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.49, Medium term – 1.47, Short term – 1.47

Economic release today –

- NIL

Commentary –

- Pound is hovering around 1.46 area.

USD/JPY –

Trading at 111.2

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is weakest of the lot as Japan prepares to launch fiscal stimulus and delayed sales tax hike. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.993

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- KOF leading indicator rose to 102.9 from 102.6

Commentary –

- Franc is flat for the day. We expect Franc to strengthen against Dollar to as high as 0.9 area in the medium term.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX