Dollar index trading at 93.24 (-0.28%)

Strength meter (today so far) – Euro +0.51%, Franc +0.42%, Yen -0.98%, GBP +0.69%

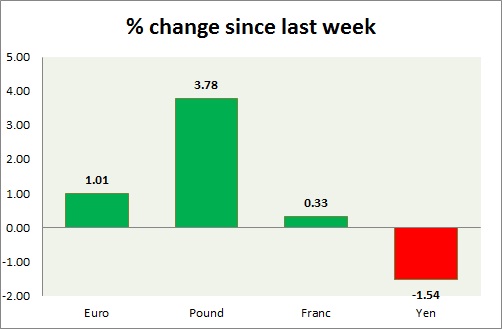

Strength meter (since last week) – Euro +1.01%, Franc +0.33%, Yen -1.54%, GBP +3.78%

EUR/USD –

Trading at 1.138

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – range

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.2, Medium term – 1.16, Short term – 1.145

Economic release today –

- Markit manufacturing PMI improved to 52.6 and services PMI declined to 52.4

Commentary –

- Euro is rising along with hope that UK will remain inside the Union.

GBP/USD –

Trading at 1.488

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.4

Resistance –

- Long term – 1.49, Medium term – 1.473, Short term – 1.473

Economic release today –

- NIL

Commentary –

- Pound is rising steadily as referendum vote likely to favor staying inside the EU.

USD/JPY –

Trading at 105.7

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- Corporate service prices rose to 23:50 GMT.

Commentary –

- Yen is the worst performer of the week as risk aversion fades with rising hope for UK remaining inside the Union. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.955

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 1

Economic release today –

- Zew survey expectations rose to 19.4

Commentary –

- Franc is likely to test 0.95 area. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.