Dollar index trading at 96.2 (-0.06%)

Strength meter (today so far) – Euro -0.02%, Franc -0.19%, Yen +0.66%, GBP +0.05%

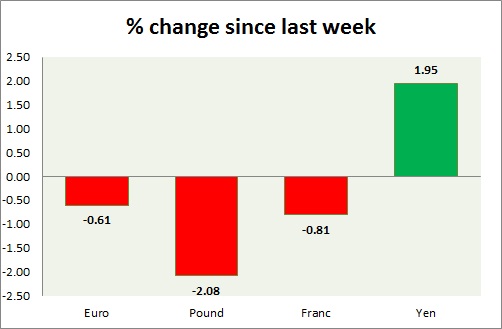

Strength meter (since last week) – Euro -0.61%, Franc -0.81%, Yen +1.95%, GBP -2.08%

EUR/USD –

Trading at 1.116

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.145, Short term – 1.12

Economic release today –

- NIL

Commentary –

- Euro faced selloffs from key resistance around 1.116. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01

GBP/USD –

Trading at 1.313

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.25, Short term – 1.25

Resistance –

- Long term – 1.5, Medium term – 1.38, Short term – 1.35

Economic release today –

- NIL

Commentary –

- Pound has slid further to a new 31-year low against the dollar. We expect the pound to reach parity.

USD/JPY –

Trading at 101.8

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 100

Resistance –

- Long term – 111, Medium term – 107, Short term – 103.5

Economic release today –

- Japan will announce FX reserve at 23:50 GMT.

Commentary –

- Yen turned the best performer today and this week again as risk aversion returned in the market. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added.

USD/CHF –

Trading at 0.972

Trend meter –

- Long term – Buy, Medium term – Range/Sell, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- NIL

Commentary –

- Franc is back moving in line with the euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022