Dollar index trading at 94.90 (+0.1%)

Strength meter (today so far) – Euro +0.00%, Franc -0.12%, Yen -0.48%, GBP -0.04%

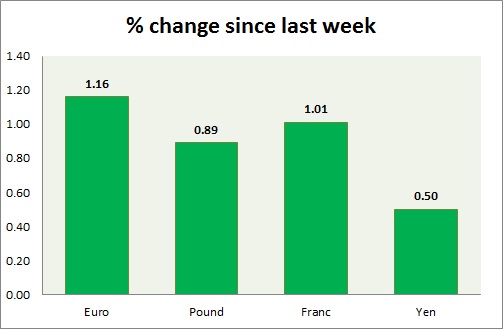

Strength meter (since last week) – Euro +1.16%, Franc +1.01%, Yen +0.50%, GBP +0.89%

EUR/USD –

Trading at 1.128

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.09

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- Trade balance for June came at £29.2 billion.

- Zew survey economic sentiment rose to 4.6 for August compared to -14.7 in July.

Commentary –

- Euro is the best performer this week, scaled back some of the gains as dollar rebounds. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01

GBP/USD –

Trading at 1.303

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.27, Short term – 1.29

Resistance –

- Long term – 1.39, Medium term – 1.35, Short term – 1.34

Economic release today –

- Unemployment rate for July came at 4.9 percent. Wages grew by 2.4 percent including bonus and by 2.3 percent excluding it.

Commentary –

- The pound is back above 1.3 area as inflation rises in July. We expect the pound to reach parity.

USD/JPY –

Trading at 100.6

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 98

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- Trade balance for July will be announced at 23:50 GMT.

Commentary –

- The yen is the worst performer of the day as speculators scaled back long positions in anticipation of an action from the Bank of Japan. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.963

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- Zew survey expectations declined to -2.8 in August from 5.9 in July.

Commentary –

- Franc is up in line with Euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022