Dollar index trading at 97.62 (+0.37%)

Strength meter (today so far) – Euro -0.66%, Franc -0.93%, Yen -1.31%, GBP -0.78%

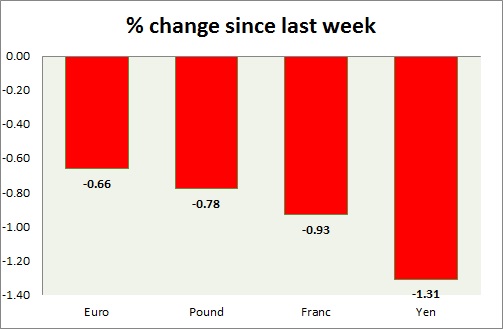

Strength meter (since last week) – Euro -0.66%, Franc -0.93%, Yen -1.31%, GBP -0.78%

EUR/USD –

Trading at 1.107

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.08

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- Sentix investor confidence for November rose to 13.1 from 8.5 prior.

- Retail sales rose by 1.1 percent in September.

Commentary –

- The euro is down as the dollar moved higher after FBI clears Clinton again. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.241

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.25, Short term – 1.24

Economic release today –

- Halifax house prices rose by 5.2 percent in three months to October. In October, it rose by 1.4 percent.

Commentary –

- The pound is sharply down today over Brexit feud and strong dollar. The pound has reached our target 1.2 area. We expect the pound to reach parity.

USD/JPY –

Trading at 104.4

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 98

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- Markit services PMI rose to 50.5 in October.

Commentary –

- The yen lost ground as risk affinity returns sharply. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.976

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.995

Economic release today –

- Swiss FX reserve rose to 630 billion.

- Consumer price index declined by 0.2 percent in October, up 0.1 percent from a year ago.

Commentary –

- Franc is down in line with the euro. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term. However, this call is under threat currently. We could soon revise the call.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022