Dollar index trading at 95.34 (-0.27%).

Strength meter (today so far) - Euro +0.08%, Franc -0.07%, Yen -0.02%, GBP +0.79%

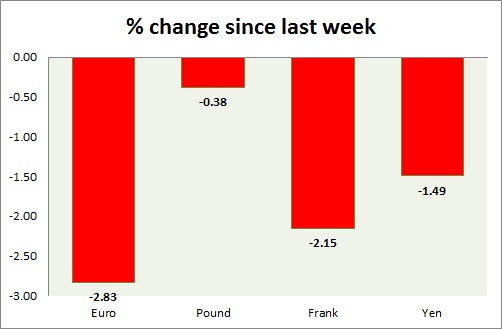

Strength meter (since last week) - Euro -2.83%, Franc -2.15%, Yen -1.49%, GBP -0.38%

EUR/USD -

Trading at 1.11

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Range

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11-1.106

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.15

Economic release today -

- Euro zone manufacturing PMI grew to 52.3 from 52 prior and PMI for services dropped to 53.3 from 54.

Commentary -

- Euro posed comeback post PMI data, trading as high as 1.118 after bouncing back from 1.107. However sellers continue to appear at every rallies pushing pair lower around 1.11.

GBP/USD -

Trading at 1.567

Trend meter -

- Long term - Range, Medium term - Buy Support, Short term - Range/Buy support

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.537-1.534

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.582-1.584

Economic release today -

- Retail sales bounced back sharply in April, growing 1.2% m/m and 4.7% from a year ago.

Commentary -

- Pound is the best performer today, jumped back from trend line as retail sales snapped back sharply.

USD/JPY -

Trading at 121.2

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122.

Economic release today -

- NIL

Commentary -

- Yen is moving up gradually taking cues from broad based dollar index.

USD/CHF -

Trading at 0.936

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.947

Economic release today -

- NIL

Commentary -

- Franc is almost flat today against dollar. Franc is to take cue from Dollar strength. Further rise is possible, however buying at dips is recommended as resistance lies ahead.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate