Dollar index trading at 97 (+0.13%).

Strength meter (today so far) - Euro +0.05%, Franc +0.25%, Yen -0.22%%, GBP -0.29%

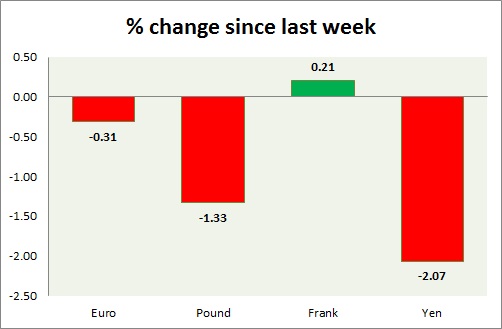

Strength meter (since last week) - Euro -0.16%, Franc +0.50%, Yen -1.95%, GBP -1.21%

EUR/USD -

Trading at 1.099

Trend meter -

- Long term - Sell, Medium term - Range/Sell, Short term - Range/Sell Resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.065

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.12-1.123, Immediate - 1.103-1.105

Economic release today -

- M3 money supply grew by 5.3% in April from a year ago.

Commentary -

- Euro rose to almost 1.10 today, before it was pushed back to consolidate around 1.097.

GBP/USD -

Trading at 1.528

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.566-1.57, Immediate - 1.535

Economic release today -

- NIL

Commentary -

- Pound is the worst performer today and dropped to as low as 1.521 in intraday before bouncing to 1.527 area.

USD/JPY -

Trading at 123.9

Trend meter -

- Long term - Buy, Medium term - Rang/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119, Immediate - 122.8

Resistance -

- Long term - 130, Medium term - 125, Short term - 125

Economic release today -

- Crucial CPI details along with unemployment stats are scheduled at 23:30 GMT, followed by industrial production at 23:50 GMT.

Commentary -

- Yen is again the worst performer today lost about 2% against dollar this week. Further loss is likely however 125 area is expected to provide support to yen.

USD/CHF -

Trading at 0.938

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy support

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90, Immediate - 0.925

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Swiss GDP for first quarter was worse than expected. Shrank -0.2% q/q. KOF leading indicator improved to 93.1 compared to 89.8 prior.

Commentary -

- Franc stands as the best performer this week so far and only currency to be positive over Green buck this week so far.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary