Dollar index trading at 100.52 (+0.03%)

Strength meter (today so far) – Euro +0.05%, Franc +0.08%, Yen -0.04%, GBP -0.53%

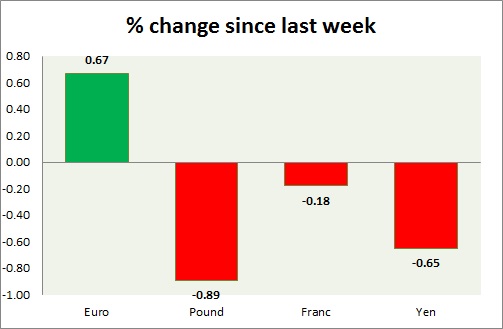

Strength meter (since last week) – Euro +0.67%, Franc -0.18%, Yen -0.65%, GBP -0.89%

EUR/USD –

Trading at 1.073

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.054

Resistance –

- Long term – 1.13, Medium term – 1.11, Short term – 1.09

Economic release today –

- NIL

Commentary –

- The euro is testing key support turned resistance at 1.08. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.26

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- BRC shop prices declined by 1.7 percent in November.

- Halifax house prices are up 6 percent in three months to November from a year ago.

- Manufacturing production declined by 0.9 percent in October, down 0.4 percent from a year back.

- Industrial production declined 1.3 percent in October.

Commentary –

- The pound is up further on weaker dollar. We expect the pound to reach parity.

USD/JPY –

Trading at 114

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Buy

Support –

- Long term – 91, Medium term – 98, Short term – 105

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Leading economic index came at 101 in October.

- Coincident index came at 113.9 in October.

Commentary –

- The yen is testing key support around 115 area. Further decline likely after correction.

USD/CHF –

Trading at 1.01

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Buy

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Forex reserve rose to 648 billion.

Commentary –

- Franc is relatively worse performer compared to the euro. Franc might decline to 1.08 per dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022