Dollar index trading at 100.96 (+0.29%)

Strength meter (today so far) – Euro -0.43%, Franc -0.42%, Yen -0.36%, GBP -0.25%

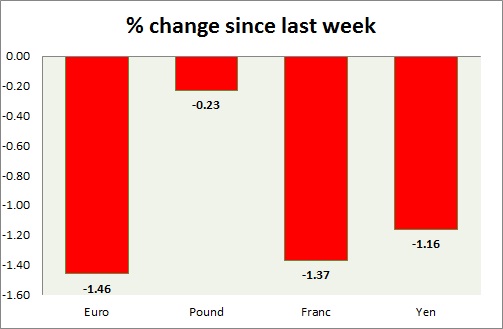

Strength meter (since last week) – Euro -1.46%, Franc -1.37%, Yen -1.16%, GBP -0.23%

EUR/USD –

Trading at 1.061

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- NIL

Commentary –

- The euro remains the worst performer of the week driven by French, Dutch, and German elections. Dollar recovered grounds after Donald Trump’s tax comments.

GBP/USD –

Trading at 1.244

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- Manufacturing production rose by 4 percent y/y in December, industrial production is up 4.3 percent y/y.

Commentary –

- The pound remains the best performer of the week so far, but down against the dollar. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.7

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- NIL

Commentary –

- The yen retreated as the dollar rose after Trump’s tax comments. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 1.005

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc declined past parity. Franc is likely to weaken further against the dollar in the longer run. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX