Dollar index trading at 95.49 (+0.30%).

Strength meter (today so far) - Euro -0.44%, Franc +0.05%, Yen -0.22%, GBP -0.07%

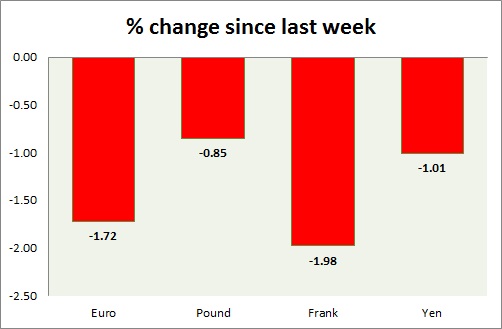

Strength meter (since last week) - Euro -1.72%, Franc -1.98%, Yen -1.01%, GBP -0.85%

EUR/USD -

Trading at 1.115

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.106, Immediate - 1.118-1.115(broken)

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.129-1.132

Economic release today -

- NIL

Commentary -

- Euro has broken below key immediate support area, further drop is likely, however focus remains on Greek crisis.

GBP/USD -

Trading at 1.573

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.548-1.545

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.595, Immediate - 1.582

Economic release today -

- NIL

Commentary -

- Pound has performed well today, however remains sell against dollar with stop around 1.582 and 1.595 and target around 1.532

USD/JPY -

Trading at 123.6

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy support

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119, Immediate - 122.2-122.6

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 124.4

Economic release today -

- CPI and unemployment is scheduled at 23:30 GMT.

Commentary -

- Yen is likely to lose further grounds against dollar over coming days.

USD/CHF -

Trading at 0.936

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy support

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is the worst performer this week, but was positive today. Franc remains medium term sell against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?