Dollar index trading at 96.55 (+0.35%).

Strength meter (today so far) - Euro -0.52%, Franc -0.35%, Yen -0.36%, GBP -0.06%

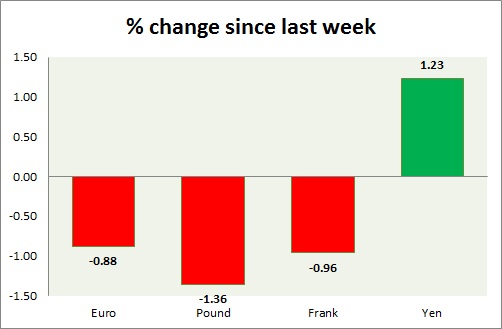

Strength meter (since last week) - Euro -0.46%, Franc -0.96%, Yen +1.23%, GBP -1.36%

EUR/USD -

Trading at 1.101

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- NIL

Commentary -

- Euro is trading in tight 120 pips range, which might remain so until the Greek matter settles over weekend.

GBP/USD -

Trading at 1.536

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.53

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.565, Immediate - 1.55

Economic release today -

- BOE maintained policy steady today.

Commentary -

- Pound is treading water around support area of 1.535 today.

USD/JPY -

Trading at 121.3

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 122(broken)

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 123

Economic release today -

- Eco watcher's survey showed for current situation dropped to 51 from 53.3 while outlook dropped 53.5 from 54.5 prior.

Commentary -

- Yen is top loser today, as risk aversion subsided.

USD/CHF -

Trading at 0.949

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy support

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is likely to remain sell against dollar. Some safe haven bids keeping the Franc buoyant.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings