Dollar index trading at 97.88 (-0.08%).

Strength meter (today so far) - Euro +0.22%, Franc -0.25%, Yen -0.17%, GBP -0.11%

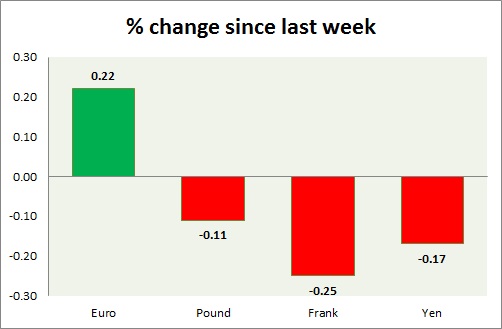

Strength meter (since last week) - Euro +0.22%, Franc -0.25%, Yen -0.17%, GBP -0.11%

EUR/USD -

Trading at 1.084

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Euro Zone current account came at € 18 billion.

Commentary -

- Euro is the best performer today, as it takes support in short term area.

GBP/USD -

Trading at 1.558

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy support/ Sell resistance

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- NIL

Commentary -

- Pound is down today after last week's massive gain against all pairs. A larger correction is possible.

USD/JPY -

Trading at 124.3

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 124.3

Economic release today -

- NIL

Commentary -

- Yen is testing key resistance. The pair has moved into consolidation. Yen might lose to 127 against dollar, if risk aversion subsides further.

USD/CHF -

Trading at 0.963

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy support

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Retail sales dropped by -1.8% in May from a year ago.

Commentary -

- Franc is the worst performer today and likely to drop further. The pair is likely to reach as high as 0.987 against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate