Dollar index trading at 99.12 (-0.27%)

Strength meter (today so far) – Euro +0.43%, Franc +0.23%, Yen -0.07%, GBP +0.23%

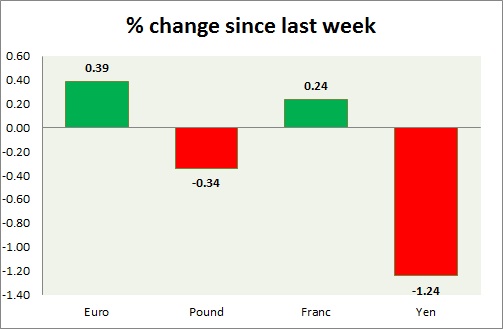

Strength meter (since last week) – Euro +0.39%, Franc +0.24%, Yen -1.24%, GBP -0.34%

EUR/USD –

Trading at 1.093

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.06

Resistance –

- Long term – 1.11, Medium term – 1.09, Short term – 1.09

Economic release today –

- Markit services PMI improves to 56.4 in April.

- Retail sales are up 2.3 percent y/y in March.

Commentary –

- The euro is flirting with resistance around 1.09 area. The focus in on upcoming French election on Sunday.

GBP/USD –

Trading at 1.29

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- UK services PMI improves to 55.8 in April.

- Money supply grew by 6.6 percent y/y in March.

- Consumer credit March grew to £1.624 billion.

Commentary –

- The pound is testing resistance around 1.3 area. Weakened as the EU hardened its stance towards Britain. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.9

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- NIL

Commentary –

- The yen’s disastrous performance continues as stocks continue to benefit from risk on sentiment.

USD/CHF –

Trading at 0.992

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc’s performance weakened since yesterday, consolidation likely to continue. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022