Dollar index trading at 96.41 (-0.81%).

Strength meter (today so far) - Euro +1.29%, Franc +0.07%, Yen +0.46%, GBP +0.44%

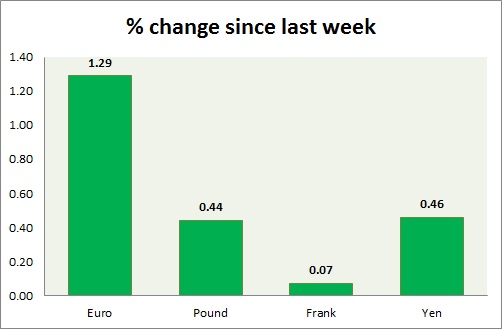

Strength meter (since last week) - Euro +1.29%, Franc +0.07%, Yen +0.46%, GBP +0.44%

EUR/USD -

Trading at 1.112

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- NIL

Commentary -

- Euro is the best performer today and seems likely to test resistance area around 1.12 this week.

GBP/USD -

Trading at 1.557

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- CBI industrial survey pointed to weakness in activity.

Commentary -

- Pound gained some ground against dollar today after US durable goods orders. Outlook remains cloudy.

USD/JPY -

Trading at 123.2

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 124.3

Economic release today -

- NIL

Commentary -

- Yen is well bid today as risk aversion pushed global equities lower. Chinese sell offs especially worrisome. However Yen still remains sell against dollar. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.961

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/buy support

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc gained back some ground but remains sell against dollar. The pair is likely to reach as high as 0.987 against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?