Dollar index trading at 97.96 (-0.23%)

Strength meter (today so far) – Euro +0.13%, Franc +0.06%, Yen +0.28%, GBP +0.31%

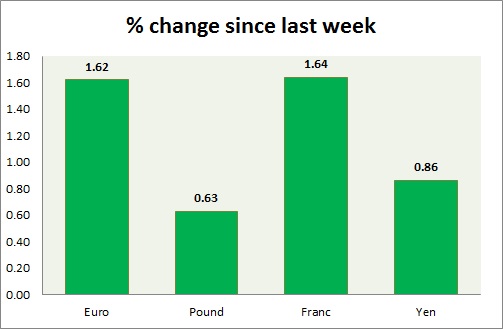

Strength meter (since last week) – Euro +1.62%, Franc +1.64%, Yen +0.86%, GBP +0.63%

EUR/USD –

Trading at 1.11

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support

- Long term – 1.05, Medium term – 1.07, Short term – 1.09

Resistance –

- Long term – 1.12, Medium term – 1.10 (broken), Short term – 1.10 (broken)

Economic release today –

- Consumer price inflation up 1.9 percent from a year ago in April.

Commentary –

- The euro is benefiting from risk affinity; the top performer of the week.

GBP/USD –

Trading at 1.296

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- ILO unemployment report declined to 4.6 percent.

- Average earnings rose 2.1 percent excluding bonus and by 2.4 percent including it.

Commentary –

- The pound continues to struggle around key resistance around 1.30 area. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 112.4

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 109, Medium term – 110, Short term – 112

Resistance –

- Long term – 119, Medium term – 115, Short term – 115

Economic release today –

- Industrial production declined by 1.9 percent in March, up 3.5 percent y/y.

Commentary –

- The yen’s performance improved after reports surfaced alleging that president Trump released sensitive information to Russian foreign minister Sergei Lavrov and that he urged the former FBI director James Comey to end Flynn investigation.

USD/CHF –

Trading at 0.984

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is up in line with the euro, the best performer of the week. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed