Dollar index trading at 95.97 (-1.27%).

Strength meter (today so far) - Euro +1.43%, Franc +1.92%, Yen +1.00%, GBP +0.35%

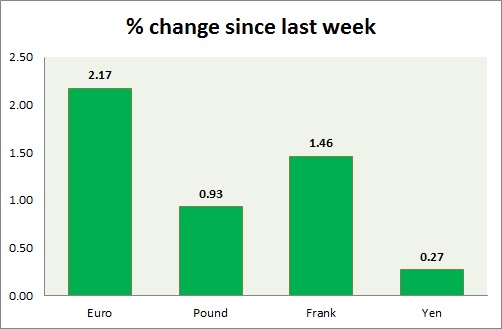

Strength meter (since last week) - Euro +2.17%, Franc +1.46%, Yen +0.27%, GBP +0.93%

EUR/USD -

Trading at 1.12

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/ Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Euro zone industrial production grew by 1.2% y/y in June, lower than 1.6% in May.

Commentary -

- Euro is the best performer this week, rallies further today as Dollar weakened due to Chinese devaluation fuelling concern over rate hike.

GBP/USD -

Trading at 1.563

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- RICS house price balance to be released at 23:00 GMT.

Commentary -

- Pound is continuing its range and remains the worst performer today.

USD/JPY -

Trading at 123.9

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5.

Economic release today -

- Industrial production rose by 1.1% in June from May, up 2.3% on yearly basis.

- Machinery orders scheduled for release at 23:50 GMT.

Commentary -

- Yen rose sharply amid weaker Dollar and risk aversion, however it is likely to remain sell against Dollar. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.969

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Zew survey expectation rose to 5.9 for August from -5.4 in July.

Commentary -

- Franc is the best performer this week, over heavy profit booking at key level. USD/CHF has reached our target of 0.987 area.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary