Dollar index trading at 93.44 (+0.13%)

Strength meter (today so far) – Euro -0.08%, Franc -0.35%, Yen -0.05%, GBP -0.07%

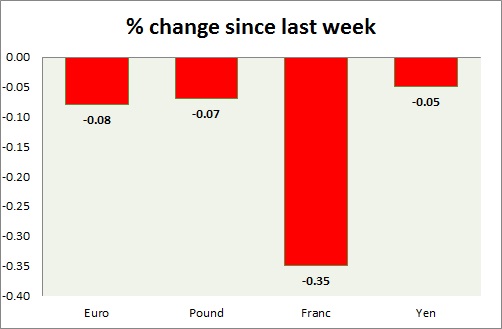

Strength meter (since last week) – Euro -0.08%, Franc -0.35%, Yen -0.05%, GBP -0.07%

EUR/USD –

Trading at 1.173

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Breakout/ Buy

Support

- Long term – 1.11, Medium term – 1.125, Short term – 1.14

Resistance –

- Long term – 1.20, Medium term – 1.18, Short term – 1.18

Economic release today –

- The unemployment rate declined to 9.1 percent in June.

- Consumer price is up 1.3 percent in July. Core price is up 1.2 percent y/y.

Commentary –

- The euro is consolidating around 1.17 area as the focus turns on US jobs report. Active Call: Buy euro targeting 1.19

GBP/USD –

Trading at 1.311

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.26, Medium term – 1.275, Short term – 1.293

Resistance –

- Long term – 1.345, Medium term – 1.32, Short term – 1.32

Economic release today –

- Net lending to individuals in June was £5.6 billion.

- Mortgage approvals were 64,684.

- Money supply declined by 0.2 percent in June, up 5.3 percent from a year ago.

Commentary –

- The pound is consolidating below key resistance around 1.32 area.

USD/JPY –

Trading at 110.6

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 110

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Housing starts up 1.7 percent in June from a year ago.

- Construction orders are up 2.3 percent y/y.

Commentary –

- The yen is heading for a test of resistance around 110.

USD/CHF –

Trading at 0.97

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- NIL

Commentary –

- The Swiss franc is the worst performer of the day so far. Active call – sell pair targeting 0.92

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022