Dollar index trading at 93.69 (+0.24%)

Strength meter (today so far) – Euro -0.22%, Franc -0.00%, Yen -0.42%, GBP -0.71%

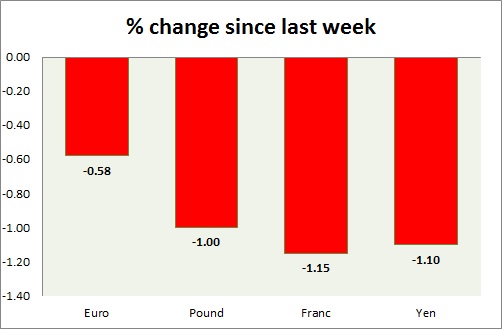

Strength meter (since last week) – Euro -0.58%, Franc -1.15%, Yen -1.10%, GBP -1.00%

EUR/USD –

Trading at 1.175

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Breakout/ Buy

Support

- Long term – 1.12, Medium term – 1.14, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.19, Short term – 1.19

Economic release today –

- NIL

Commentary –

- The euro declines as the dollar recovers since Friday. Active Call: target reached at 1.19

GBP/USD –

Trading at 1.287

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.26, Medium term – 1.275, Short term – 1.293

Resistance –

- Long term – 1.345, Medium term – 1.32, Short term – 1.32

Economic release today –

- The retail price index is up0.2 percent in July, up 3.6 percent from a year ago.

- House price index is up 4.9 percent from a year ago.

- Producer price index is up 3.2 percent from a year ago.

- Consumer price index is up 2.6 percent from a year ago.

- Core CPI is up 2.4 percent from a year ago.

Commentary –

- The pound is declining as the inflation data disappoints and housing market weakens. Active call – Sell pound at 1.291 with target at 1.24

USD/JPY –

Trading at 110.4

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 110

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Industrial production is up 2.2 percent in June up 5.5 percent from a year ago.

Commentary –

- The yen lost grounds as North Korean tensions ease but is likely to gain further against the dollar. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.972

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- Producer and import price index down -0.1 percent from a year ago.

Commentary –

- Franc is the worst performer of the week. Active call – sell pair targeting 0.92

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest