Dollar index trading at 93.26 (+0.07%)

Strength meter (today so far) – Euro -0.20%, Franc +0.10%, Yen -0.45%, GBP +0.10%

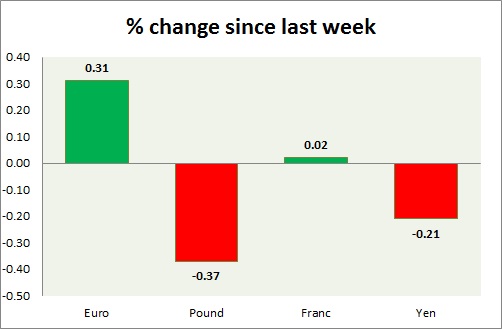

Strength meter (since last week) – +0.31%, Franc +0.2%, Yen -0.21%, GBP -0.37%

EUR/USD –

Trading at 1.179

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Breakout/ Buy

Support

- Long term – 1.12, Medium term – 1.14, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.19, Short term – 1.19

Economic release today –

- NIL

Commentary –

- The euro consolidating ahead of Jackson Hole. The best performer of the week so far. Further downside correction likely.

GBP/USD –

Trading at 1.281

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.26, Medium term – 1.275, Short term – 1.293

Resistance –

- Long term – 1.345, Medium term – 1.32, Short term – 1.32

Economic release today –

- BBA mortgage approvals rose to 41,587 in July.

- Second quarter GDP is up 0.3 percent q/q and up 1.7 percent from a year ago. No growth in business investments.

Commentary –

- The pound is struggling as it failed to clear key down trend line. The worst performer of the week. Active call – Sell pound at 1.291 with target at 1.24

USD/JPY –

Trading at 109.4

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 109

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Coincident index improved to 117.1 in June and leading economic index improved to 105.9

- Tokyo and National CPI reports will be released at 23:30 GMT.

Commentary –

- The yen is testing a key resistance around 109. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.964

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- Industrial production is up 2.9 percent q/q in the second quarter, up 2.8 percent from a year ago.

Commentary –

- Franc is a much worse performer than the euro this week so far. Active call – sell pair targeting 0.92

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022