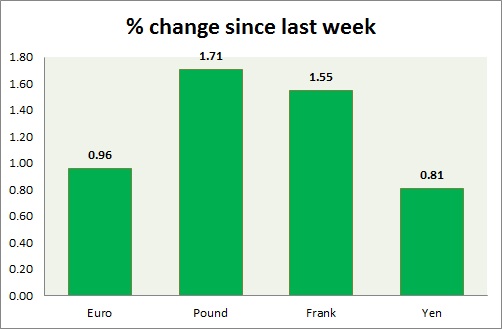

Dollar is the king of this week rising against all the majors (EUR, GBP, CHF, and JPY) and the focus is now on NFP report. A chart and table is attached for explanation.

- Euro continues to break down as ECB president Mario Draghi reiterated the Bank's commitment towards the purchase programme. It is to start on March 9, 2015. Usually this NFP report day remains with subdued trading but Euro is under heavy pressure and moving towards the parity against dollar. Euro is currently trading at 1.096, bouncing back from intraday low of 1.093 before the payroll report. Immediate Support lies at 1.082, 1.054 & Resistance 1.11.

- Pound has followed Euro in the downside, the move further gained conviction after inflation expectation among UK public fell to 1.9% against 2.5%. Pound is currently trading at 1.519. Immediate Support lies at 1.50 & Resistance 1.531.

- Yen has lost grounds against dollar this week but yet not broken above the resistance, trading sideways. NFP report may provide further guidance. A break could increase the yen momentum towards the target of 124. Yen is currently trading at 120. Immediate Support lies at 118.2 & Resistance 120.5, 121.70.

- Franc, still the top loser of the week, has reached its initial target of 0.976 and could see some gains against dollar on weaker than expected NFP report. Franc is currently trading at 0.976. Immediate Support lies at 0.939 & Resistance 0.982.

|

Euro |

-2.03% |

|

Pound |

-1.56% |

|

Frank |

-2.36% |

|

Yen |

-0.35% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand