Dollar index trading at 93.81 (-0.14%)

Strength meter (today so far) – Euro +0.11%, Franc -0.26%, Yen -0.22%, GBP +0.87%

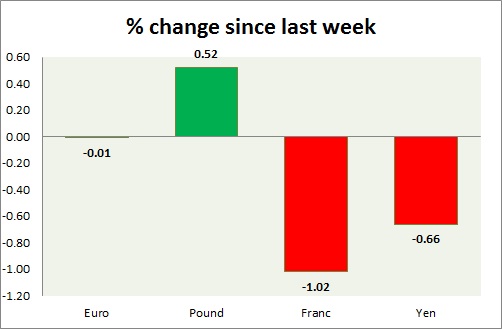

Strength meter (since last week) – Euro -0.01%, Franc -1.02%, Yen -0.66%, GBP +0.52%

EUR/USD –

Trading at 1.177

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.14, Medium term – 1.16, Short term – 1.175 (testing)

Resistance –

- Long term – 1.22, Medium term – 1.22, Short term – 1.22

Economic release today –

- NIL

Commentary –

- The euro remains down this week over Catalonia tension and strong dollar. The focus is on ECB monetary policy. Active call – Sell targeting 1.14

GBP/USD –

Trading at 1.325

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.28, Medium term – 1.295, Short term – 1.313 (testing)

Resistance –

- Long term – 1.38 Medium term – 1.36, Short term – 1.36

Economic release today –

- BBA mortgage applications came at 41,584 in September.

- GDP rose by 0.4 percent q/q in the third quarter, up 1.5 percent from a year ago.

Commentary –

- The pound is the best performer of the day and the week as GDP outperforms.

USD/JPY –

Trading at 114.2

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 108.4

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Corporate service price report will be released at 23:50 GMT.

Commentary –

- The yen is down this week as incumbent Prime Minister Shinzo Abe in for massive victory. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.988

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987 (testing)

Economic release today –

- UBS consumption indicator rose to 1.56 in September.

- Zew survey expectation index rose to 32 in October.

Commentary –

- Franc is the worst performer of the week. Active call – Buy pair targeting 1.02

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX