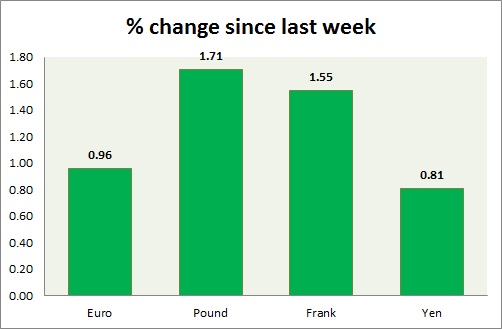

Dollar performed extremely well last week rising against all the majors (EUR, GBP, CHF, and JPY) and today giving up some gains over profit booking. A chart and table is attached for explanation.

- Euro continues to fell pressure at rallies even in today's trading after Strong NFP report and as ECB bond purchase begins today. Cot report published last week saw trimming in Euro speculative position for consecutive three week to -172,400 contracts from prior -177,700 contracts. Sentix investor confidence improved to 18.6 from prior 12.4. Euro is currently trading at 1.086, bouncing back from near the support on profit bookings. Immediate Support lies at 1.082, 1.054 & Resistance 1.1045.

- Pound is much better performer today in intraday trading but still facing headwinds over last week's fall. Pound is currently trading at 1.511. Bearish bets on GBP increased by 5000 contracts to - 26,900 contracts. Immediate Support lies at 1.50 & Resistance 1.529.

- Yen has broken the key resistance last week but gained ground today over profit bookings. Japanese GDP released over weekend showed persistent weakness in the economy. GDP grew at 0.4% for fourth quarter. A break above 121.7 could provide momentum towards the target of 124. Yen is currently trading at 119.5. Speculators increased bets on weak yen by 5000 contracts to -52,500 contracts. Immediate Support lies at 118.2 & Resistance 121.70.

- Franc continues to lose ground against the dollar after it broke above the resistance over stronger non-farm. Franc is currently trading at 0.985. Speculators maintained their short position to -6000 contracts. Immediate Support lies at 0.954 & Resistance 1.02. Parity level could pose some interim resistance.

|

Euro |

0.10% |

|

Pound |

0.53% |

|

Frank |

-0.91% |

|

Yen |

-0.27% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?