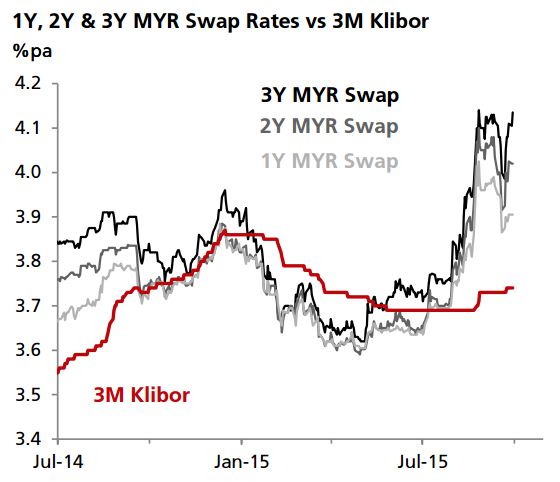

MYR market rates have been under upward pressure in recent weeks amid ongoing political challenges and a protracted period of depressed oil prices. Notably, the 3M Klibor has also inched up to 3.74% after staying stable at 3.69% for the most part of June to August pushing up MYR swap rates in the process.

Higher rates are a reflection of tighter liquidity conditions as MYR weakness persists. Notably, as sentiment sours, the USD/MYR has pushed above 4.4 while the 5Y USD credit default swap (CDS) spread has pushed to 234bps, levels not seen since the global financial crisis.

Risks of rate hikes has also likely been priced into short-term rates as the market focused on the fact that foreign reserves have fallen very sharply over the past twelve months. With sentiment staying weak and oil prices not yet staging a meaningful rebound, there are worries that the authorities may have to do more to stabilize the market (including raising the policy rate). At his point, these fears are likely premature. While the 3M Klibor did inch up recently, its spread over the policy rate remains relatively tight and did not approach levels seen in late 2014. An improvement in sentiment and/or a rebound in oil prices should see MYR rates drift lower.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022