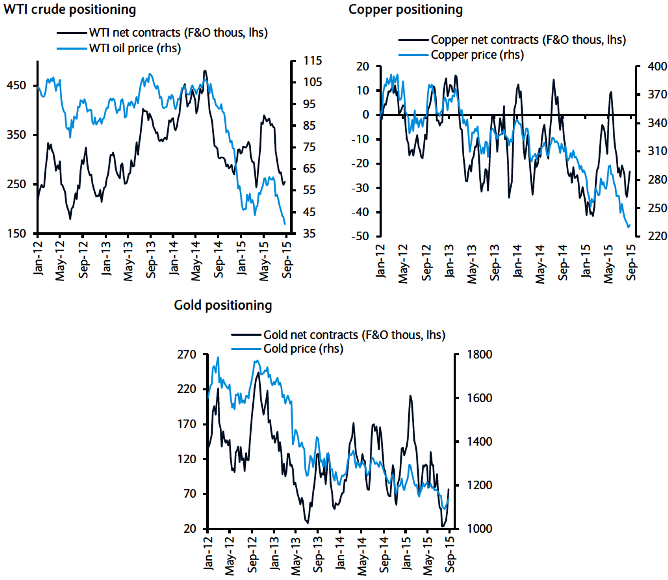

Crude oil: WTI net longs have been cut considerably over the past few weeks and seem to have stabilized. We believe today's extended losses evidenced only due to the data release of US oil inventory levels. Oil futures extended losses from the prior session on Monday as ongoing worries over the health of the global economy fueled concerns that a global supply glut may stick around for longer than anticipated.

Copper: Copper net shorts were pared from very high levels, it has been a good week for copper as the prices stated regaining to one and half month highs at 2.437. Copper prices have been under heavy selling pressure in recent months as fears of a China-led global economic slowdown spooked traders and rattled sentiment. Prices of the red metal earlier sank to a six-year low of $2.251 as concerns over the health of China's economy and steep declines on Chinese stock markets dampened appetite for the red metal.

Gold: The yellow metal had additions of net longs after positioning dropped to the lowest levels since 2003; the metal has been losing its precious value as it dropped close to a 6 years low of $1,119.88 today.

Corn net longs have been cut from elevated levels. Wheat remained net short, while soybeans had a sharp cut in net long contracts in the past two weeks.

Declining commodity sentiments in unison

Wednesday, September 9, 2015 11:16 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it