Chinese stock market has rallied close to 80% in last 12 months, fueled by policy easing by PBOC, country's central bank.

However investors should exercise caution as the current rally is partially being fuelled by higher leverage. Local investors have been buying stocks in margin that is to say buying $1000 worth of stocks by just depositing $100. Investors' positions will be squared off, should the losses exceed their deposit margin of $100.

Recent report suggests margin debt is close RMB 1 trillion.

This is sure to raise market volatility, should the stocks go for deeper correction and that move could trigger deleveraging resulting in massive correction.

The story is not limited to stock market.

- According to Financial Times, bets over Chinese currency appreciation and to profit from yield differentials between USD and RMB, EUR and RMB might be hundreds of billions of dollar.

- Chinese companies have gobbled up lot of dollar denominated loans since the financial crisis of 2008. Higher interest rates in US trigger another set of deleveraging. Companies in anticipation started converting loans from USD to Euro.

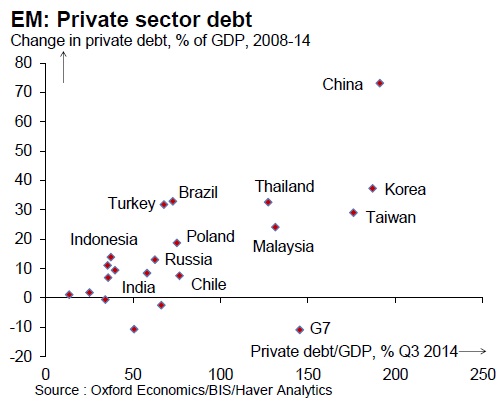

- Net private sector debt, according to Oxford economics rose in Emerging markets as a whole. For China increase accounts for 80% of GDP from 2008 to 2014.

At this moment of time, it is not clear what might trigger deleveraging, however risks remain high for such in future.

Current stock market rally might not be pricing the risk completely.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?