As the major gamut of cryptocurrencies seems to be staged for gaining the upside traction in 2020, traders have begun finding ways of protecting their bitcoin holdings from risk. Find out how to hedge bitcoin risk – including three cryptocurrency hedging strategies.

Let’s just quickly glance at the underlying security price trend before we deep dive in to the hedging aspects of bitcoin.

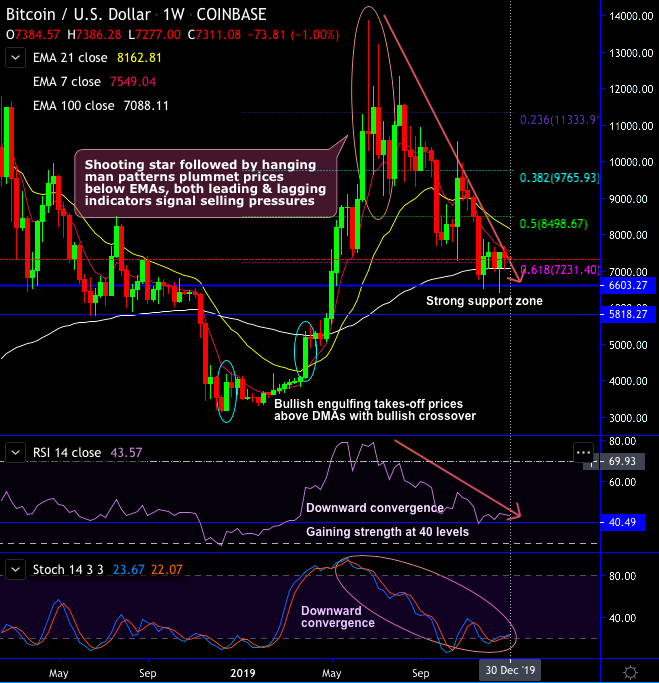

BTCUSD (at Coinbase) is currently trading at around $7,360 levels (while articulating).

The bitcoin bulls staged for resumptions of uptrend as 100-EMA and 61.8% Fibonacci levels provide crucial cushion for the bitcoin prices.

Please be noted that the year-2019 has been mixed bag of sentiments for both bulls and bears, at the beginning of the year, bitcoin price surged from the lows of $3,122 to the recent highs of $13,880 levels (i.e. mammoth returns of 344 in percentage terms that too within a span of 6 months or so, refer 1st chart).

Although Year-2019 has been instrumental for bitcoin exchanges and crypto-traders because exchanges sit with their assured commission regardless of profits or losses, and crypto-traders have had opportunities for swing trading. For investors, it has been little turbulent. However, such robust uptrend has generated various price gaps in the CME Bitcoin futures contracts.

Technically, Shooting star plummets prices below EMAs, both leading oscillators in tandem with price slumps in intermediate trend of BTCUSD, the underlying price has retraced 61.8% Fibonacci levels that has wiped off most of the gains in the year-2019. Whereas the slumps have halted at that juncture and showing some strong supports. As a result, hammer pattern occurred at $7,513 levels to counter (1st chart for weekly plotting).

Bulls, in the minor trend, counter with engulfing pattern at $7,285.53 level (refer 2nd chart for daily plotting), Bullish engulfing pattern takes off rallies above 7 & 21-SMAs, the upswings reclaimed $7.5k levels, both leading oscillators indicate buying momentum.

We could see the stiff resistance levels at around $7,700 – 7,764 levels, if bulls manage to breakout these levels decisively, then we could foresee more upside traction easily upto $8.5k levels.

Hence, longs in CME BTC Futures of January deliveries are advocated on both hedging and trading grounds (spot reference: $7,305). For trading, maintain a strict stop losses at 7,085 and 6,603 for the targets up to $8,500 levels.

For the trading purpose, avoid contracts with lower volumes and lower open interest.

Please be noted that usually, the volume and open interests would be small at the early stages of futures contract life and expands as it reaches the maturity period and again drop during close to expiration stage.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential