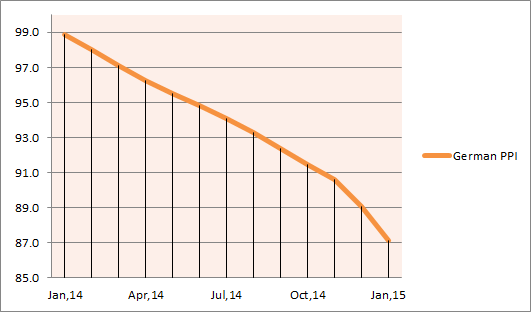

The German Producer price Index data was published today at 7 am GMT.

- Latest report shows that PPI has decreased once more. MoM data came at -0.6% higher than expected -0.4% and YoY at -2.2% accelerating from the previous -1.7%.

- The outlooks for inflation prompt the central bank to take up unprecedented step towards asset purchase which was announced in January and to start from March, 2015.

- A chart is attached that show the path of the PPI over the last one year taking December 2013 as base year. It is falling and recent time has increased the pace. Part of such could be slippage of lower oil price but it is worth noting that it has been falling beforehand.

- Euro so far has muted impact over the data, but the data points ahead will be ever more vital to watch out the effect of central bank purchase programme of € 60 billion a month.

Outlook for the euro remains bearish against the dollar. Since we have been saying that at this euro valuation European assets look cheaper even at the backdrop of turmoil, European assets could see portfolio flows which will affect the euro short term.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate