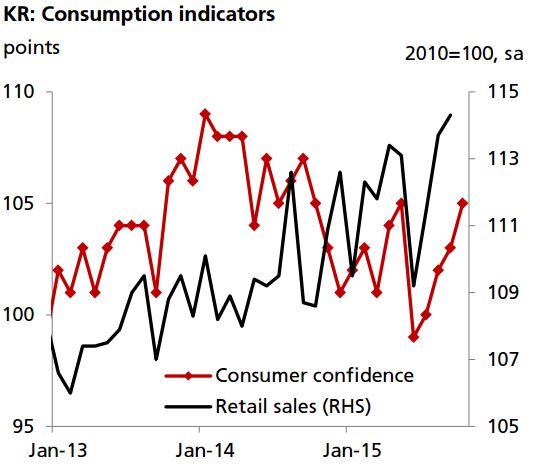

Domestic recovery is well on track. Consumption growth is picking up thanks to the end of MERS and the release of pent up demand. As of September, retail sales have been rising for three consecutive months. Consumer confidence has completely returned to the levels prior to the MERS outbreak.

Meanwhile, the real estate sector has maintained a cyclical upturn, helped by the decline in borrowing costs to record lows. Whilst the recovery initially came from property demand, it is now spreading to the supply side. Construction investment surged strongly by 19.3% (QoQ saar) in 3Q, which boosted GDP growth by 2.6ppt.

The recovery in domestic demand was in stark contrast with the sluggishness in external trade. The latest data showed that exports shrank 15.8% (YoY) in Oct, a further decline from -8.4% in Sep. Manufacturing PMI remained below the neutral level at 49.1 in Oct, barely changed from 49.2 in Sep.

Looking ahead, we expect domestic demand to maintain a recovery trend and bolster GDP growth at the 3% level in 4Q15 and 1H16. The post MERS recovery in public sentiment should be a one-off phenomenon. But the impact of monetary and fiscal stimuli (rate cut, consumption tax cut and supplementary budget) has not been fully realized and will continue to play out in the coming quarters. An improvement in domestic growth indicators is expected to cool down the talk about further BOK rate cuts and support the short-term KTB yields.

Domestic recovery is well on track in South Korea

Korea Consumption Indicators

Tuesday, November 3, 2015 2:19 AM UTC

Editor's Picks

- Market Data

Most Popular