Changes in economy occurs first at micro levels (companies, production of goods), which then gets reflected in macro levels (GDP, inflation).

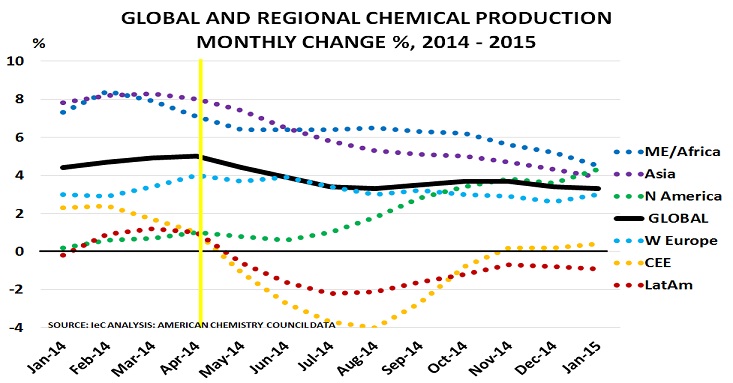

- In lot many ways, growth in chemical companies viz. production is a leading economic indicator and the current condition is expressed nicely in a chart from ICIS, a market intelligence provider in chemical and fertilizer industry.

- Global growth peaked in January 2014 to 5.1% have lagged since then and currently at 3.3%

- Growth in North America has increased significantly from 0.1% in January 2014 to more than 4% as of now. This reaffirms the return of growth in US.

- Growth in Middle East has slowed from 8% in February 2014 to 4.5% as of now.

- Growth in Asia slowed to 3.9% from its peak around 8% in early 2014.

- Growth has remained subdued across Euro zone though it shows some signs of recovery. In central and eastern Europe growth slumped to - 4% however started recovering since then.

- Latin America continues to experience negative growth.

Analogy -

- Global recovery would take longer despite strong US economy. Central banks are to keep monetary policies ultra-loose.

- However as situation improves across Euro zone and ECB vows to keep monetary policy loose, the equities might gain further.

- Diverging growth in Asia, Middle East and Latin America compared to US, might keep the dollar stronger against the currencies of these regions.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?