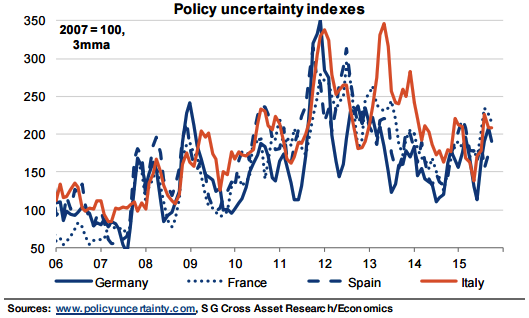

The high degree of policy-related uncertainty witnessed in Italy since the 2008 crisis can be linked to the lack of stable institutions and weak business environment.

A reduction is expected in the probability of the country being subject to the same sort of political gridlock/crises as in the past. This would make economic policy more predictable, which in turn, of course, should have a positive effect on the economy.

The confidence of individuals and businesses, as well as their knowledge of future economic policy and regulatory changes, directly shapes their incentives to spend, invest or hire since there is greater visibility on future levels of income.

"In fact, a permanent 10% drop in the policy uncertainty index is expected to translate into a 0.3% increase in GDP growth and would lead to the creation of 30,000 additional jobs in the long term", says Societe Generale.

Drop in Italy's policy uncertainty index to translate into increase in GDP growth

Wednesday, October 21, 2015 5:23 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed