When the governing council of the European Central Bank meets in Frankfurt on April 21, it’s likely to leave monetary policy unchanged. At its March meeting, the ECB cut its main “refi” rate by five basis points (bp) to zero, reduced its other key interest rates, and expanded the monthly purchases under its asset purchase programme (APP) to €80 billion (£64 billion) starting this month. It is likely to take no action until it determines what effect those latest changes have.

The ECB did show that they still have the capacity to surprise the market. Forward guidance indicated that interest rates are expected to remain “at present or lower levels” for an extended period of time. Hence further rate cuts have not been ruled out. Nevertheless, President Draghi’s comments in the press conference will be closely watched, in particular, whether he will repeat that “we don’t anticipate that it will be necessary to reduce rates further”.

“The ECB is expected to remain ready to act if needed, but we are reaching the effective limits of ECB policy. No further action is expected this year but we expect the APP to continue until the end of next year while also a TLTRO III is likely in 2017,” write the researchers at Credit Suisse.

Latest indicators suggest that eurozone economic activity has held up in Q1 and the rate of growth may exceed the modest outturns of 0.3%q/q in the second half of 2015. Lift to real incomes from low inflation and gradual improvement in the labour market is likely to have supported consumption, which is expected to remain a key driver of growth this year. The first estimate of Q1 GDP is due on 29th of April and is expected to have held up despite survey evidence pointing to a weakening of business and consumer confidence.

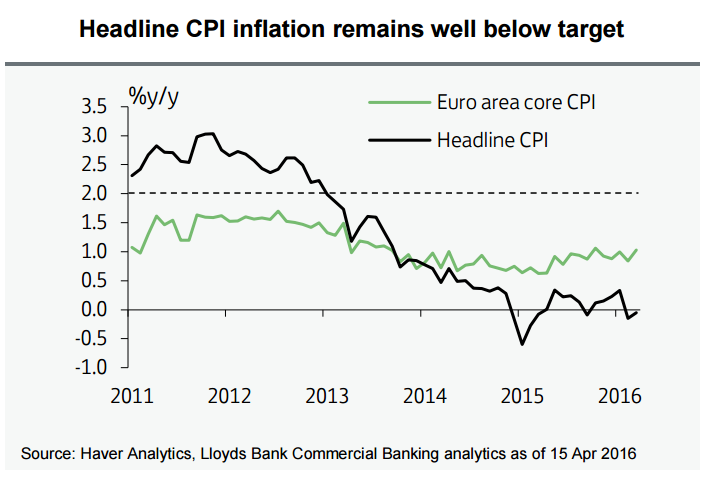

After dipping into negative territory in Feb eurozone headline CPI inflation moved back up to 0.0%y/y in March, but still remains well below the ECB target. Headline inflation in March was likely boosted by rise in services prices due to earlier timing of Easter this year, as well as less downward impact from energy prices as a result of the recovery in global oil prices. The rise towards target will be gradual, as spare capacity in the economy and weak wage growth dampen the impact of growth in domestic demand.

"We expect annual headline inflation to remain around zero percent in Q2, before moving gradually higher in the second half of the year. Overall, we expect headline CPI inflation to average 0.3% for the year as a whole, before rising to 1.4% in 2017." said Lloyds Bank in a report.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings